Welcome to 2026!

It’s a new year and a new opportunity for everyone. Many people take the first part of January to review the previous year and make plans for the new year – both in personal and business plans. I remember as a young finance company manager having to spend tiring hours in January preparing my office business plan, submitting it and then have it returned from head office with all the goals increased and expense budgets cut. Then the negotiations with my boss to try to get the business plan achievable.

Plans don’t have to be monetary or economic. They can be lifestyle changes. Did you make a new year’s resolution this year? I haven’t in years, but this year I decided to play more classical guitar so I committed to practising a minimum of four hours per week. What new year’s resolution did you make? Some people don’t like to make new years resolutions, but even if you didn’t what ones would you make? It’s great to spend time in reflection and imaging the new year turning out better with dreams coming true!

December was a great month at Drake Financial and January is starting off busy with TFSA contributions and new investments. Many people review their financial plans in January and top up their TFSA’s and RRSP’s. I encourage you to do the same. Feel free to contact the office to make an appointment to discuss your needs. Also, we will be having an TFSA and RSP promotion starting next week so stay tuned for the announcement.

January is also when experts make predictions. So here are my predictions of economic events that would impact our Canadian economy.

• US Supreme court strikes down Trump’s use of tariffs

• Canada grows non-US international trade

• Stock market waivers and has a down year

• Canadian economy narrowly avoids a recession

• Artificial Intelligence is harnessed to become part of everyday life

Next January (or sooner with my first prediction) we can compare and see how my predictions fared.

Maybe you want to make some predictions and write them down to compare next year too.

For investment recommendations, we continue to recommend mortgage investment corporation shares due to their diversity in the mortgage market and steady returns that have outpaced the stock markets over the long term. Many investors are diversifying with our GICs. Ask us about which GIC might be right for you. As members of the Registered Deposit Brokers Association of Canada, we have access to all the banks and credit unions across Canada.

Here are a few pictures from our Drake booth at the Chilliwack Home and Garden show.

Monthly Quiz

Here is a quiz to test your knowledge of 2025 newsworthy events:

QUIZ: Reviewing the news of 2025 | Abbotsford News

Financial Literacy

TFSAs Explained

A tax-free savings account offers a flexible way to save or invest for the future, for any Canadian 18 years or older. Remember:

• You can save tax free for any goal you want (car, home, vacation).

• You don’t need earned income to contribute, and you don’t have to set up a TFSA or file a tax return to earn contribution room.

• All Canadians have the same TFSA contribution room each year. The annual contribution limit is indexed for inflation, which means some years the contribution room will increase as inflation goes up.

• You can put money into your spouse’s or common-law partner’s account.

• You can take money out when you want, for any reason, without paying any tax. If you take money out, you can re-contribute it the following year, in addition to the annual maximum.

• You can hold a wide range of investments in a TFSA, like cash, GICs, MICs, and DMI's.

Read about TFSA and RRSP strategies from our 2024 blog here:

Welcome to February — Drake Financial Ltd.

Useful links:

The difference between TFSAs and RRSPa explained:

Welcome to February — Drake Financial Ltd.

2025 real estate metrics for Abbotsford, BC

Property assessments drop 5% for average Abbotsford home | Abbotsford News

Abbotsford home sales hit lowest point in more than a decade | Abbotsford News

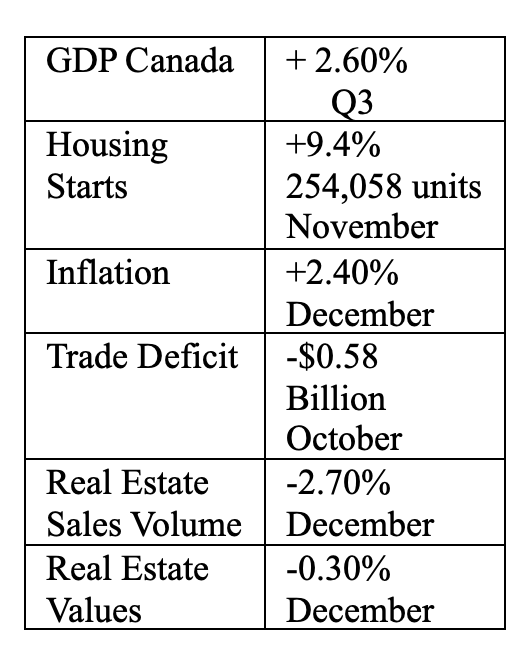

2025 Canadian real estate metrics

The three provinces bucking Canada's housing downturn | Financial Post